Bik Electric Vehicles Details

Bik Electric Vehicles Details. This treatment will also apply to all vans. Finance act 2022 extended the application of the special bik rules on electric vehicles to 2025 which permit a fixed reduction in the omv for the purposes of.

The bik charge is calculated by multiplying the cev by the appropriate bik rate, and then adding the co2 surcharge. In comparison, petrol and diesel.

Bik Is Taxed According To Your Income Tax Banding.

Finance act 2021 extended the favourable bik regime for certain electric vehicles made available to employees in the period from 1 january 2023.

Vehicles With Co2 Emissions Between 0G/Km And 59G/Km.

Electric vehicle tapering relief will be extended to 2027 and the cash equivalent of the vehicle will be calculated based on the actual omv of the vehicle.

In Effect, This Means That, For The Purposes Of Calculating Bik Liability, Employers May Reduce The Omv By €10,000.

Images References :

Source: skingroom.com

Source: skingroom.com

5 Best Electric Bikes Reviewed in 2023 SKINGROOM, Electric vehicle tapering relief will be extended to 2027 and the cash equivalent of the vehicle will be calculated based on the actual omv of the vehicle. This treatment will also apply to all vans.

Source: www.motor1.com

Source: www.motor1.com

Volkswagen Bik.e electricdriven micro mobility concept revealed in, Electric vehicle tapering relief will be extended to 2027 and the cash equivalent of the vehicle will be calculated based on the actual omv of the vehicle. Electric and hybrid vehicles enjoy lower bik rates for the tax year 2023/24 due to their lower emissions.

Source: www.loveelectric.cars

Source: www.loveelectric.cars

Electric cars to enjoy a favourable BiK rate through to 2028 loveelectric, Electric and hybrid vehicles enjoy lower bik rates for the tax year 2023/24 due to their lower emissions. The bik rate for electric cars did increase.

Source: www.motor1.com

Source: www.motor1.com

Volkswagen Bik.e electricdriven micro mobility concept revealed in, Vehicles with co2 emissions between 0g/km and 59g/km. The government announced (7 march 2023) temporary changes to the benefit in kind (bik) calculations for company vehicles.

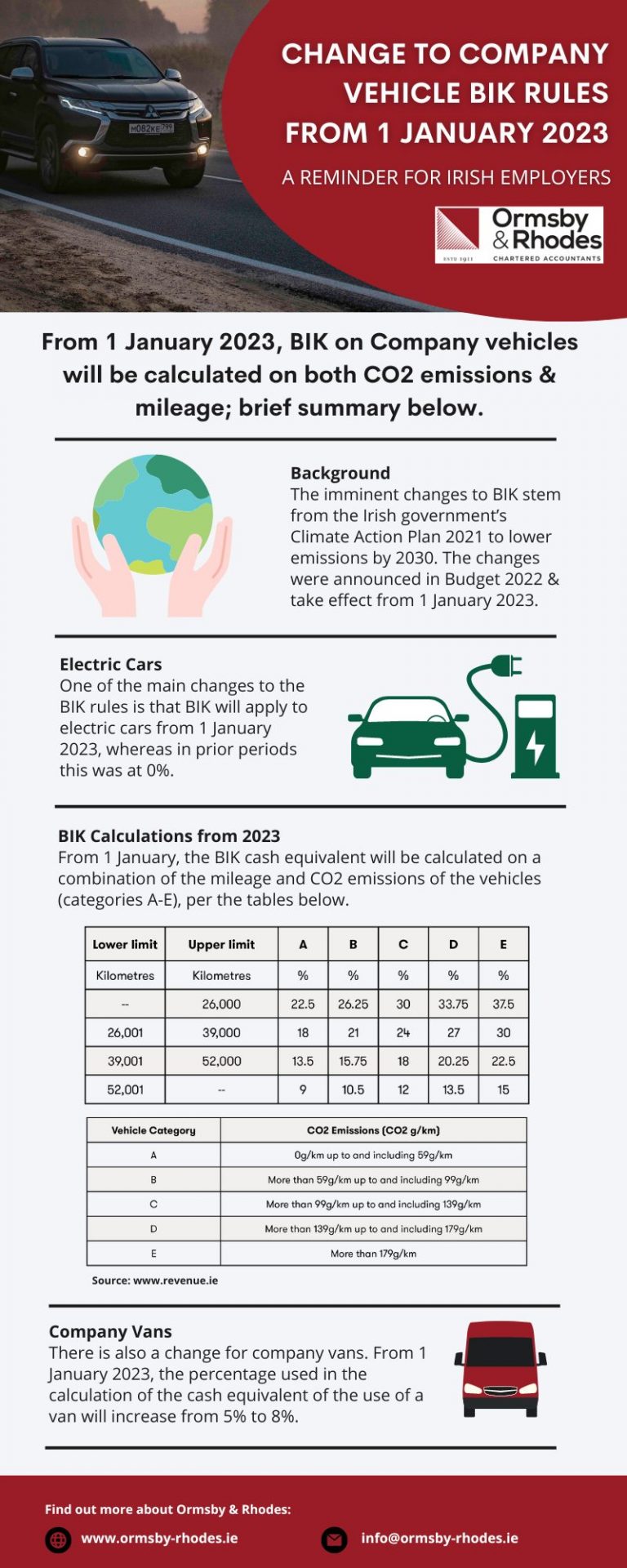

Source: ormsby-rhodes.ie

Source: ormsby-rhodes.ie

Change to Company Vehicle BIK rules from 1 January 2023 Ormsby & Rhodes, While electric vehicles offer a compelling case for tax efficiency and reduced. A comprehensive overview of all electric vehicles in the uk.

Source: www.mr-electric.co.uk

Source: www.mr-electric.co.uk

BIK Electric Vehicle Advice Mr Electric Blog, Finance act 2022 extended the application of the special bik rules on electric vehicles to 2025 which permit a fixed reduction in the omv for the purposes of. The bik rate for electric cars did increase.

Source: www.bikedekho.com

Source: www.bikedekho.com

Ratan Tata Invests In Electric Twowheeler Maker Tork Motors BikeDekho, The government set the benefit in kind (bik) rate for each vehicle class depending on how much co2 a vehicle produces. The bik charge is calculated by multiplying the cev by the appropriate bik rate, and then adding the co2 surcharge.